What is the Average Down Payment When Purchasing A Home?

I am going to be this will surprise you….One of the top concerns for home buyers, especially first-time buyers, is having enough money for a down payment. I have some great research to share with you and I am hope this information will be encouraging to you or anyone you know who would like to purchase a home but is worried they do not have enough the right funds to make that dream a reality.

Coming up with enough cash for a down payment to buy a house is the single biggest roadblock for most prospective home buyers.

But how much do you really need?

There is a misconception that buyers assume they MUST put down 20%.

Certainly there a benefits to putting down 20%, however it is POSSIBLE for homebuyers to qualify for loans with a smaller down payment. And in fact, many buyers are taking advantage of these programs…do you know about them?

If concern over needing a large down payment is stopping you from reaching your dreams of buying a new house, then read on and let me show you how I can help.

What Is a Down Payment?

A down payment is the cash you pay upfront to make a large purchase, such as a car or a home, and is expressed as a percentage of the price. A 10% down payment on a $350,000 home would be $35,000.

When applying for a mortgage to buy a house, the down payment is your contribution toward the purchase and represents your initial ownership stake in the home. The lender provides the rest of the money to buy the property.

Lenders require a down payment for most mortgages. However, there are exceptions, such as with VA loans and USDA loans, which are backed by the federal government, and usually do not require down payments.

What is the Average Down Payment?

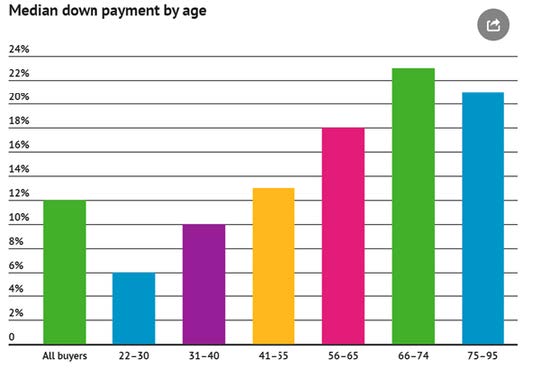

According to a recent report from the National Association of Realtors , the average down payment on a house for first-time buyers is just 7%, whereas repeated buyers put down an average of 16%. Check out this chart below that breaks down the median down payment by age.

How Do You Accomplish This?

Well, every situation is unique, however there are different loan programs offered by lenders to help achieve your goals. The top three are listed below, but please know there are so many programs for first time home buyers, teachers, first responders, etc.

- FHA loans – which are backed by the Federal HousingAdministration, require as little as 3.5% down.

2. VA loans – guaranteed by the U.S. Department of Veterans Affairs, usually do not require a down payment. VA loans are for current and veteran military service members and eligible surviving spouses.

3. Conventional Loans – Lately, the requirements for each type of residence under this loan depend on your credit score. If your credit score is above 620, it might help lower your payment. Keep in mind that though some lenders may require you to put 6% down, the minimum down payment for a house under a conventional loan is 3%. The better your credit score, the higher your creditworthiness will seem.

If you are dreaming of home ownership there is a path to make that happen! Email me and let’s begin the discussion of what those first steps should be for your situation. Many people think that waiting to communicate with an agent until they are ready to go look at houses is the correct order. I like to begin helping my clients in the planning portion of their purchasing process. So even if you are a year (or even two) from purchasing, I can help make sure you are on the right path, in touch with the right people, and not doing too much or too little to reach your goal.

You Can Do This!!

Hi, there!

I'm Jennifer Mestayer (Med-E-A) and I love helping Cypress families buy and sell their

homes as they move through the varying stages of life. From first homes to forever homes...

Let me know how I can help you make your real estate dreams come true.

Let's Meet

Contact

713.670.4113

Cy-Fair Real Estate

16718 House & Haul Rd, St N

Cypress, TX 77433

jennifer@movewithmestayer.com

Buy

My Listings

Sell

All Articles

schedule your free consultation